Homeowners in Proviso Township were mailed Reassessment Notices on September 29, 2023, and have until Monday, October 30, 2023, to file an appeal if they choose to do so. The estimated Fair Market Value listed on the Reassessment Notice will be reflected on tax bills in 2024.

In 2022, median sale prices of single-family homes in Proviso Township were about $278K for single-family homes; $145K for condos; and $368K for small apartment buildings. The Assessor’s Office estimated the 2023 median market value of single-family homes in Proviso Township is $240K, for condos the median market value is $122K, and is $312K for small apartment buildings. Estimates depend on the individual property’s location and characteristics.

The Assessor's Office hosts virtual and in-person events to provide information and answer your questions about reassessments and appeals. Visit our events page here.

The data below shows the Assessor's median estimated market values of all homes throughout Proviso Township, and sales trends from 2018 - 2022.

Compare the Real Estate Market to the Assessor's Estimate of your Home

Every assessment township is divided further into Neighborhood Codes. You can find your home’s neighborhood code on its Reassessment Notice and on the PIN detail page. Homeowners can compare the real estate market to the Assessor's estimate of their home’s value using the interactive map below.

1. Identify Your Neighborhood Code

1. Identify Your Neighborhood Code

2. Click on Your Neighborhood on the Map Below

2. Click on Your Neighborhood on the Map Below

3. Compare Recent Sales to the Assessor's Estimated Property Values

3. Compare Recent Sales to the Assessor's Estimated Property Values

Frequently Asked Questions

Where does this data come from?

The Assessor's Office receives sales data from MyDec, a tool for processing real property transfers that are managed by the Illinois Department of Revenue. The assessment data in this dashboard come from the Assessor's estimates of property value. To download assessment data for many PINs, see the open data sets we have published on Cook County's Open Data Portal.

There weren't many sales in my neighborhood in 2022. How did you estimate my home's value?

This dashboard only shows sales from last year. We used 9 years of sales across Cook County to make sure we have enough data to detect sale patterns for different locations and home characteristics.

My home sold recently. Why isn't the Assessor's "estimated value" equal to the sale price?

Setting the assessed value of a home equal to the value of a recent sale is called selective appraisal or sales chasing. Sales chasing can artificially improve assessment performance statistics and biased statistical models. Worse, it can bias assessment accuracy in favor of recently sold properties, giving an unfair advantage to areas or properties with high turnover. For more information, see Appendix E of the IAAO Standard on Ratio Studies.

Assessment Appeals

Property owners have the right to file an appeal. Appeals can be filed online and are completely free, a lawyer is not required. If the property characteristics listed on your assessment notice are incorrect, or if the estimated market value of your home is significantly more than what you believe your home could sell for in the current real estate market, you should consider filing an appeal. A good rule of thumb is this: If the property characteristics on this notice are correct and the estimated market value is within 10 percent of what you think your home is worth then it is unlikely that an appeal would change your property’s assessed value enough to significantly affect its property tax bill.

The deadline to file an appeal for properties in Proviso Township is Monday, October 30, 2023.

3 Reasons for filing an Assessment Appeal

1. Lack of Uniformity - Either you or our analysts can look at comparable properties (properties similar to yours) and determine whether the assessed value of your property is in line with the assessed values of other comparable properties.

2. Overvaluation - Supporting documentation, such as recent closing statements, or information about purchase prices of homes similar to yours can be submitted.

3. Incorrect Property Description - If a reassessment notice lists an error such as incorrect square footage, classification, or an error that may affect market value, an appeal can be filed. Supporting documentation such as property record cards or dated photos may be submitted with your appeal. It is important to remember, however, that a minor error does not necessarily indicate an incorrect assessment.

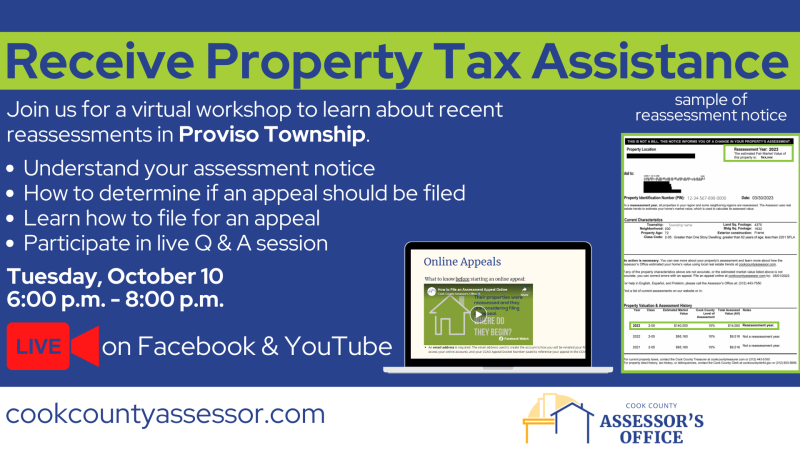

Receive Property Tax Assistance | Proviso Township

Join us for a workshop to learn about recent reassessments in Proviso Township.

- Understand your assessment notice

- How to determine if an appeal should be filed

- Learn how to file for an appeal

- Participate in live Q & A session

Market Value vs. Assessed Value

After estimating the market value of a home, the Assessor’s Office calculates the home’s Assessed Value based on its Level of Assessment.

Levels of Assessment are set by Cook County Ordinance based on the property’s major class. Single-family homes, condos, and all other 200-class properties have a 10% Level of Assessment, so the property’s Assessed Value equals 10% of its estimated market value.

A home valued at $500,000 has an assessed value of $50,000.

Note that it is not the Assessed Value that is taxed. The taxable value of the home is its final Equalized Assessed Value. This requires two more numbers:

- The Equalizer (also called the Multiplier), is calculated every year by the Illinois Department of Revenue. All properties in Cook County have the same Equalizer. Equalized Assessed Value, or EAV = the Equalizer x Assessed Value. Example: with an Equalizer of 3.0, this home’s EAV = 3.0 x $50,000 = $150,000.

- Any homestead exemptions, like the Homeowner Exemption or Senior Exemption. These subtract a fixed amount from the home’s EAV and is the same throughout Cook County. For example, the Homeowner Exemption subtracts $10,000 of EAV, and the Senior Exemption subtracts $8,000. Example: with the Homeowner and Senior exemption (both of which currently auto-renew), the home’s final EAV after exemptions = $150,000 - $10,000 - $8,000 = $132,000. This is the number to which the tax rate is applied to calculate a second installment property tax bill.

How does the model know what my home is worth?

“The model” is a computerized statistical model that uses real estate market data to estimate the value of homes that haven’t sold. These models are often called Automated Valuation Models and are the standard for conducting a computer-assisted mass appraisal.

The goal of the model is to answer this question: “What would the sale price of every home be if it had sold recently in an arms-length transaction?”

To answer this question, we use a two-step process:

- Modeling. First, we use computer code to analyze data about home sales. Any two homes may have different characteristics (location, number of bedrooms, etc.) and sale prices. But there are consistent patterns in how characteristics affect sale prices on average. It’s important to detect these patterns accurately. To do that, we use computer code to train a predictive machine learning model, which learns to recognize complex patterns much faster than a human could. The output of this step is a model which can be used to predict any home’s sale price based on its characteristics and these learned patterns.

- Valuation. We then use the model created in Step 1 to predict values for all residential properties. These predicted values are the scope of this report, but these values are subject to change. Estimated values produced by the model are reviewed by software and by our expert analysts, who review assessed value changes by neighborhood and property class and make adjustments as necessary.

- Mailing. Finally, we mail Reassessment Notices to homeowners with their property’s estimated market value, its characteristics, and its assessed value.

Learn more about our modeling process here.

Sales Ratio Analysis

In the 2023 reassessment of Proviso Township, the Assessor's Office met 2 out of 3 IAAO standards for high-quality assessments in a sales ratio analysis of single-family properties. Sales ratios are the ratio between a property’s estimated value and its recent sale price. A sales ratio analysis is a way to self-assess and ensure that the Assessor's Office is accurately valuing properties. The IAAO is an international agency that sets assessment industry standards and best practices. Below are the results of our sales ratio analysis, which measures three metrics based on sales ratios.