The Assessor's Office released its initial assessments of residential and commercial properties in Thornton Township on August 4, 2023. The deadline to file an appeal is Tuesday, September 5, 2023.

The Assessor’s Office follows a triennial reassessment cycle, which means one-third of the county is reassessed every three years. The townships scheduled for reassessment in 2023 can be found here. When a property is reassessed, the property owner is mailed a Reassessment Notice, which contains the property’s address, characteristics, and estimated Fair Market Value. The estimated Fair Market Value listed on the Reassessment Notice will be reflected on tax bills in 2024.

Numbers at a Glance: Residential

In 2022, median sale prices of single-family homes in Thornton Township were about $152K for single-family homes, $77K for condos, and $199K for small apartment buildings.

The Assessor’s Office estimated the 2023 median market value of single-family homes in Thornton Township is $124K, for condos is $73K, and $164K for small apartment buildings. Estimates depend on the individual property’s location and characteristics.

Residential Reassessment Report

Numbers at a Glance: Commercial

The chart below shows a high-level overview of the commercial properties in Thornton Township.

THORNTON TOWNSHIP COMMERCIAL PROPERTIES | ||

| Property Type | Properties | Total Market Value |

| Industrial | 515 | $ 843,868,757 |

| Office | 173 | $ 105,695,151 |

| Retail | 784 | $ 540,071,917 |

| Comm Condo | 81 | $ 8,919,233 |

| Hotels | 56 | $ 358,459,891 |

| Multifamily - Affordable | 29 | $ 43,451,363 |

| Multifamily - Market | 222 | $ 278,241,204 |

| Auto Dealership | 12 | $ 24,940,506 |

| Auto Repair | 158 | $ 47,343,151 |

| Bank | 24 | $ 24,919,282 |

| Bowling Alley | 3 | $ 2,205,934 |

| Car Wash | 17 | $ 7,894,916 |

| Department Store | 1 | $ 4,431,095 |

| Movie Theatre | 1 | $ 4,407,987 |

| Office/Warehouse | 3 | $ 3,827,276 |

| Restaurant | 6 | $ 1,366,455 |

| Self Storage | 13 | $ 37,826,330 |

| Storage | 8 | $ 2,514,718 |

| Used Car Lot | 16 | $ 3,296,331 |

| Gas Stations / Convenience | 60 | $ 69,683,858 |

| Gas station/Cstorewgas | 2 | $ 1,973,245 |

| Nursing Home | 8 | $ 88,916,205 |

| Total | 2,192 | $ 2,504,254,805 |

Commercial Reassessment Report

Appealing Property Assessments

If the property characteristics listed on an assessment notice are incorrect, or if the estimated market value of a property is significantly more than what it could sell for in the current real estate market, property owners should consider filing an appeal.

Appeals for Thornton Township can be filed until Tuesday, September 5, 2023. More information can be found at cookcountyassessor.com/appeals. To learn more about property assessments and appeals, join the Assessor’s Office at a virtual event and download this helpful guide.

Changes in Assessed Value in Thornton Township

Because of increases in the value and/or number of properties throughout Thornton, the total assessed value of the township grew %. The following table shows the increase in total assessed value in residential and non-residential properties in Thornton Township.

Property Group | 2022 (Board of Review Final) | 2023 (pre-CCAO appeals, pre-Board of Review) | Change in total Assessed Value |

Residential | $496.57M | $734.39M | $237.82M (48%) |

Large Multifamily (Class 3) | $24.94M | $29.03M | $4.09M (16%) |

Standalone Commercial | $182.36M | $229.84M | $47.48M (26%) |

Industrial | $78.69M | $128.19M | $49.50M (63%) |

Not-For-Profit | $0.42M | $0.56M | $0.14M (33%) |

All Others | $83.21M | $101.51M | $18.29M (22%) |

Total | $866.19M | $1,223.52M | $357.33M (41%) |

If the percentage increase of a Thornton property’s individual assessment went up less than the total assessed value of 41%, the property could see little change in its property tax bill or even a decline. The full impact of this reassessment on tax bills will be known in late 2024 after all appeals are processed and exemptions are applied.

How Assessments Relate to Property Taxes

Assessments, under Illinois law, should fairly reflect market values. The Assessor’s Office estimates market values by using a mass appraisal model that analyzes sales trends. Mass appraisal models rely on accurate data. If a property owner believes the characteristics listed for their property are inaccurate, or their property is worth less than the Assessor’s Office’s estimate of its value, the owner is entitled to file an appeal.

These assessments divide up the total tax levy of that property’s township, school district, and other taxing districts. A property owner’s share of taxes depends on how their property’s assessment relative to the total assessed value of their area. Therefore, an increase in a property's assessment does not lead to the same increase its tax bill.

Tax levies pay for services such as schools, parks, libraries, and pensions. The Assessor does not set levies or tax rates. Increases in assessments do not increase the revenue received by taxing districts.

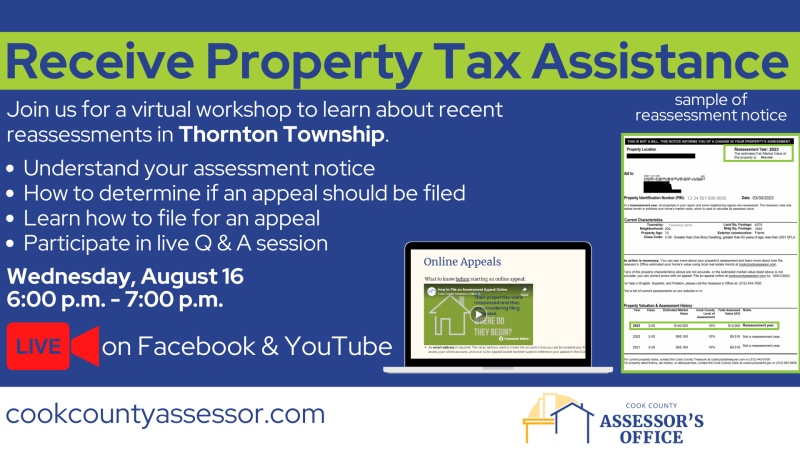

Receive Property Tax Assistance | Thornton

Join us for a workshop to learn about recent reassessments in Thornton Township.

- Understand your assessment notice

- How to determine if an appeal should be filed

- Learn how to file for an appeal

- Participate in live Q & A session

Evaluación de Propiedades en el Municipio de Thornton

- Informese sobre su aviso de evaluación

- Cómo determinar si se debe presentar una apelación

- Aprenda cómo presentar una apelación

- Participa en una sesion de preguntas y respuestas