The Cook County Assessor’s Office (CCAO) assesses unimproved real estate (1-00 class) at 10% of a property’s market value or with a 10% level of assessment. County Code, Sec. 74-63(1); County Code, Sec. 74-64(1).

Below is guidance on the qualifications of unimproved real estate (1-00 class) and how the CCAO assesses property that is transitioning from a commercial or industrial property to unimproved real estate (demolition of commercial or industrial improvements).

Unimproved Real Estate Definition

Real estate that was previously improved with commercial or industrial improvement(s) will qualify as unimproved real estate (1-00 class) for all or part of the tax year if it meets one of the three scenarios listed below.

- Scenario 1: Unimproved Real Estate During Entire Assessment Year

Scenario 1 is for parcels that were previously improved with commercial or industrial structures and did not have any major or minor improvements on the property during the assessment year and were not used for any commercial or industrial purposes during the entire assessment year. Parcels that were or are used for material storage, vehicle parking, outdoor storage, or otherwise were used for commercial or industrial purposes or used in conjunction with adjacent parcels that are used for commercial or industrial purposes during the assessment year, do not qualify as unimproved real estate (1-00 class). These parcels will be assessed with the appropriate commercial or industrial classification.

Security fencing shall not be considered an improvement on parcels that otherwise qualify for an unimproved real estate classification. A parcel that is only improved with security fencing and is not used for commercial or industrial purposes during the assessment year does qualify for unimproved real estate classification (1-00 class).

The CCAO will assess parcels that meet the criteria of Scenario 1 as unimproved real estate (1-00 class) for the entire tax year.- Scenario 2: Demolition of Industrial or Commercial Improvements Occurred During Assessment Year

Scenario 2 applies to parcels that were improved with commercial or industrial improvements at the beginning of the assessment year, but all the improvements were demolished during the assessment year, or the demolition process was significantly completed before the end of the assessment year. In these instances, the land record will be updated for the parcel in the subsequent year. As of the next January 1 lien date, the property will be classified as unimproved real estate (1-00 class). The values of the commercial or industrial improvements that were demolished will be date prorated according to the onset of demolition as validated through documents (demolition permit preferred), or as estimated by the CCAO in the absence of documentation.

Demolition of Commercial or Industrial Improvements Occurred During the Tax Year Example

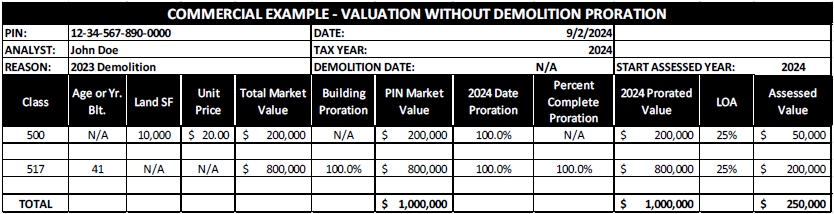

An example of how the CCAO would date prorate a commercial or industrial property due to demolition during the year shown below. The chart below shows the valuation of a commercial (5-17) property before a demolition date proration.

The land square footage is 10,000 and the land is currently a 5-00 classification (commercial land) since the land was improved with a 5-17 (commercial major improvement). The land’s market value is $200,000 and the assessed value is $50,000 (25% Level of Assessment). The 5-17 (commercial major improvement) has a market value of $800,000 and the assessed value is $200,000. This results in a total PIN market value of $1,000,000 and an assessed value of $250,000 (25% level of assessment).

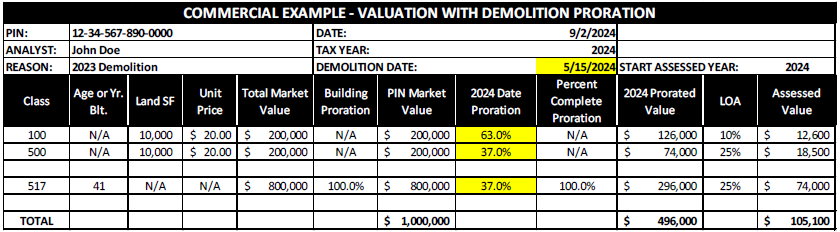

Assuming the 5-17 was demolished starting on May 15, 2024, or a valid demolition permit was issued on May 15, 2024, and the CCAO can confirm that the demolition has been significantly completed and the property is not being used for commercial or industrial purposes, the PIN would have a 2024 date proration, as shown below.

The chart above shows that the land valuation on the PIN has been divided into a 1-00 class land record (unimproved real estate) and a 5-00 class land record (commercial land), with a proration based on the demolition date. From January 1, 2024, to May 15, 2024, there were 135 days or 37% of the year (rounded to the nearest percent) and during this time the property was improved. From May 16, 2024, to December 31, 2024, the CCAO assumes the property will be vacant and 1-00 class land has been granted for this time period (63% of the year). Additionally, the 5-17 (commercial major improvement has been date prorated to May 15, 2024, as well (37% of the year). Thus, the final market value of the PIN (with consideration for the demolition) would be $496,000 and the assessed value would be $105,100.

- Scenario 3: Property Contains Commercial Remnants from Prior-Year Demolition

The parcel has commercial or industrial remnant improvement(s) from a recent demolition of major improvement(s) and the remnant improvement(s) have not been used for any commercial or industrial purposes during the assessment year. This mostly applies to asphalt, concrete, or other minor improvements that were not removed during the main demolition of the property. Parcels with remnant commercial or industrial improvements that were or are used for material storage, vehicle parking, outdoor storage, or otherwise were used for commercial or industrial purposes or in conjunction with adjacent parcels that are used for commercial or industrial purposes during the tax year do not qualify for an unimproved real estate (1-00) classification.

Cook County Assessor Appeal Recommendation

Taxpayer appeals requesting unimproved real estate classification during the current assessment year should include the following documentation:

1) Affidavit of Unimproved Real Estate

2) Demolition Permit

3) Dated photos of the property after demolition

4) Demolition contractor invoice or receipt

5) Appeal Narrative providing additional information on the demolition with important dates.

Additional related information:

Vacancy policy

How commercial property is valued

Official appeal rules

Residential exemption and appeal guides