The following explains the Cook County Assessor's approach to estimating the fair market value of properties that are under construction.

Policy Governing Properties Under Construction

The Cook County Assessor’s Office (“CCAO”) estimates the fair market value of properties that are under construction on a monthly straight-line Value-Add Model based on the “as complete” value of the property. To value properties that are under construction, the CCAO must obtain two pieces of data: 1) an estimated completion date from the owner, CoStar, the developer, or public information / published news stories; and 2) the intended use and size (units, beds, or building square feet) of the property when complete. If one or both pieces of information are not known at the time of the initial assessment, the CCAO reserves its right to assess the property as Class 1-00 unimproved real estate for the current tax year and later issue any omitted assessment(s) for the value of the building(s) in a subsequent tax year.

State statute requires the CCAO to record and assess newly added improvements and to determine their value on a proportionate basis. 35 ILCS 200/9-160. While Section 9-180 of the Code requires the valuation of improvements that are habitable or that receive occupancy permits, when read together, these provisions direct the CCAO to assess new improvements but not at their full value until the improvements are substantially complete and fit for occupancy. Long Grove Manor v. PTAB, 301 Ill. App. 3d 654, 657 (2nd Dist. 1998); Brazas v. PTAB, 339 Ill. App. 3d 978, 983 (2nd Dist. 2003). Following this guidance, the CCAO assesses new improvements on a proportionate basis at a partial value until improvements are fit for occupancy. When the CCAO knows the estimated completion date and verifies the use and size of the building “as complete,” the CCAO will proceed to estimate the fair market value of the property “as complete,” using the current assessment year's market inputs. Once the “as-complete” value has been established, the CCAO will deduct the concluded fair market value of the property’s land to arrive at the “as-complete” value of the improvements. The “as-complete” value of the improvements is then divided by the estimated duration of the construction period (in months) to obtain an estimated Value Added Per Month during the construction period. The construction starting date will be the earlier of two dates 1) the issuance of a building permit or 2) the date at which construction begins per aerial imagery. The construction end date is obtained from the owner, the developer, public information, municipal permits, or CoStar.

The value of the land remains constant during the construction period and the value of the improvements is increased each month by the estimated Value Added Per Month. Example: A property is being developed over a nine-month period and the estimated “as complete” total value is $11,000,000. If the estimated land value is $2,000,000, then the “as complete” improvement value is $9,000,000 ($11,000,000 - $2,000,000 = $9,000,000). The value added per month is $1,000,000 ($9,000,000 divided by 9 months). Thus, the estimated fair market value of the building during the first construction month is $1,000,000, the second construction month the estimated fair market value of the building is $2,000,000, the third construction month the estimated market value of the building is $3,000,000 and the value-add trend continues until the building is completed. However, the CCAO recognizes that an under-construction building would most likely sell at a discount relative to its cost basis. Therefore, the CCAO reduces the value of an under-construction building by 50% until construction is completed. The CCAO then places the average monthly improvement value on the property for the tax year.

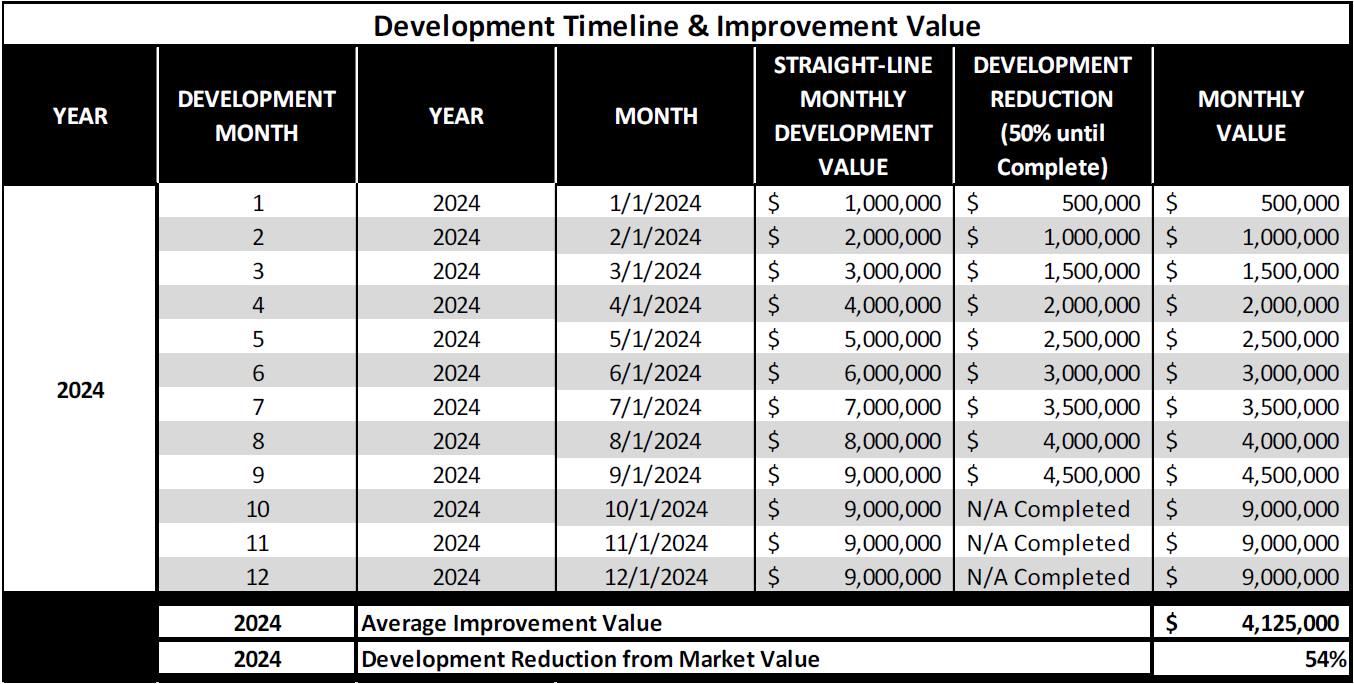

If we revisit the example of a property being developed over a 9-month period and the estimated “as complete” building value is $9,000,000, the resulting building value for the year would be $4,125,000, as shown below.

The chart above shows that the monthly estimated value is reduced by 50% until the construction is completed in October 2024. Once construction is complete, the estimated monthly value increases to $9,000,000. If the value of the land is $2,000,000, the 2024 initial assessed value of this property would be $6,125,000 ($2,000,000 land value + $4,125,000 average value).

Appeal Notes

Any owner or petitioner who appeals on a property that was under construction during the tax year can appeal on the following grounds:

- Overvaluation of the “As Complete” Value

a. If a petitioner wishes to appeal based on overvaluation during the construction process, the CCAO suggests submitting the following documents.

i. Verified contractor’s statements with the total cost of the construction (excluding land).

ii. Building permit(s) and occupancy certificate(s).

iii. Appeal narrative elaborating on the construction cost and timeline with specified dates. - Vacancy Reduction

a. The CCAO does not grant any vacancy reduction while properties are under construction since we reduce the estimated monthly building value until complete by 50 percent of its straight-line estimated value. If a property experiences vacancy after the building is completed, the CCAO may grant a date-prorated vacancy reduction. Petitioners should submit all the requested documents in the CCAO’s published Vacancy Policy. - Belief that the Assessor incorrectly attributed new improvement values to the property based on date of construction or value of improvements. Please file an appeal and submit documentation in support, including photos and dates of construction.

Additional related information:

Vacancy policy

How commercial property is valued

Official appeal rules

Residential exemption and appeal guides