Every year the Assessor's Office sends mail to households regarding property tax exemptions. Most recently booklets were sent to over 100,000 households that need to either reapply for exemptions or may be eligible to receive savings. Here is a simple reference guide to help homeowners understand the mail from our office.

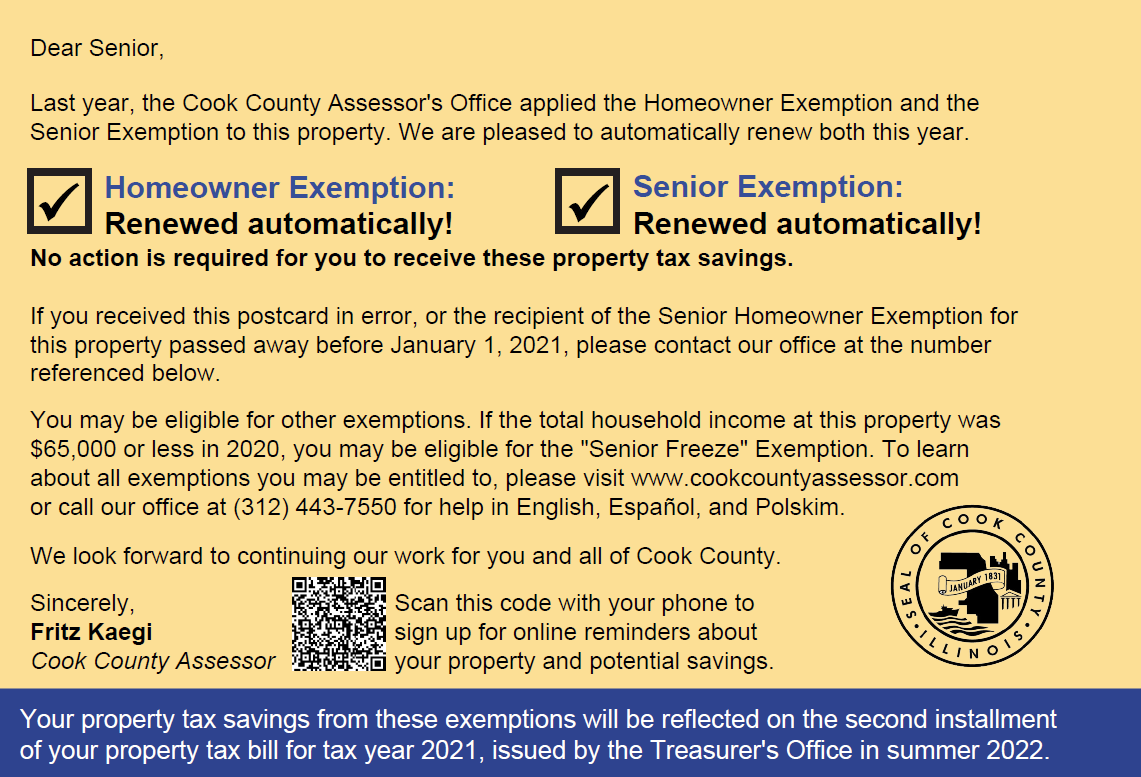

Yellow Auto-Renewal Postcard

The yellow postcard verifies that the Homeowner and Senior Exemption will automatically renew this year. No action is required by the homeowner. If you received this postcard in error or if the recipient of the Senior Exemption passed away prior to January 1, 2021, please contact our office.

Due Date: No action required

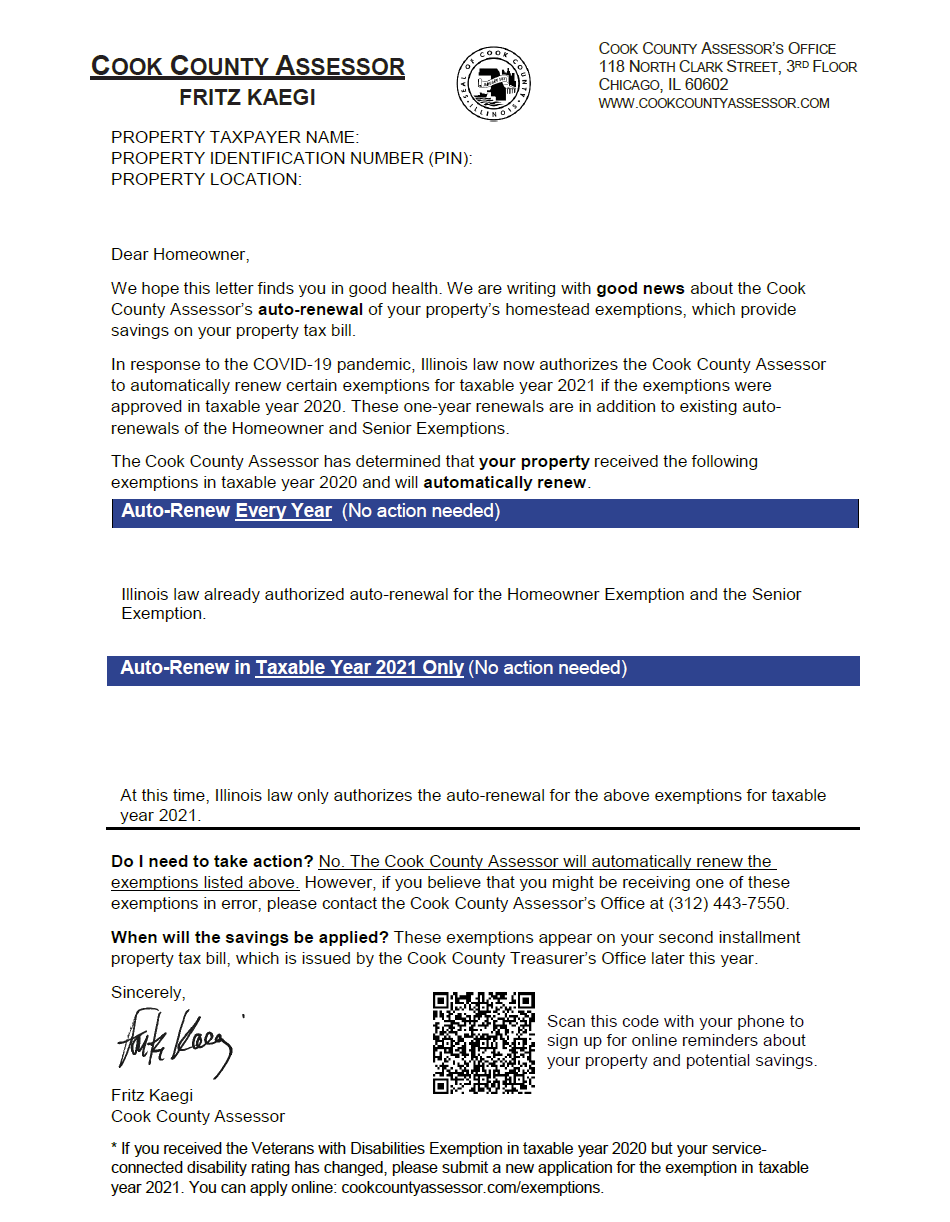

Blue Auto-Renewal Letter

The blue auto-renewal letter verifies and lists the exemptions that will automatically renew this year. In response to the COVID-19 pandemic, the Assessor's Office is automatically renewing certian exemptions for tax year 2021 if the exemptions were approved in tax year 2020. If you received this letter, the exemptions listed will automatically renew and no action is required.

Due Date: No action required

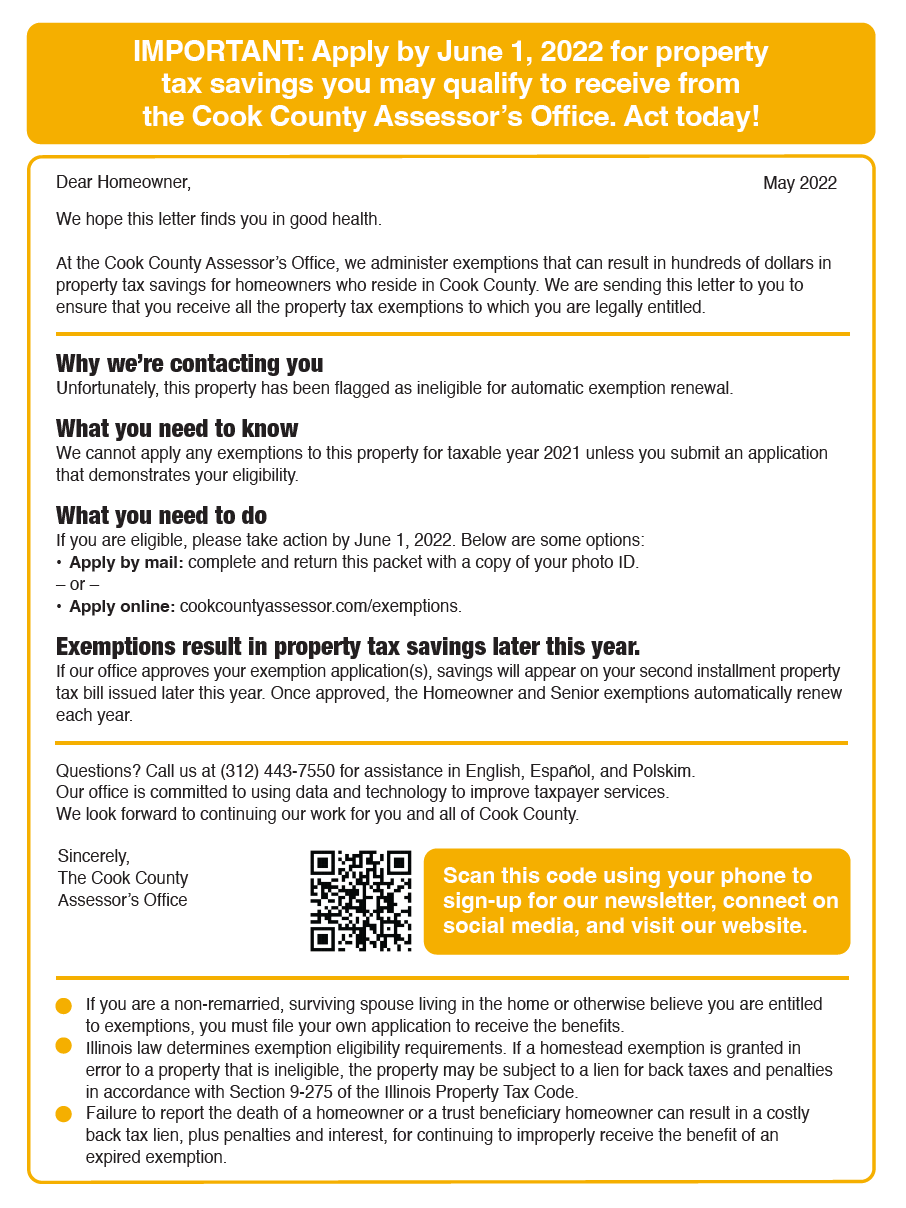

Gold Booklet

The gold booklet indicates that the household will need to reapply for exemptions this year. The booklet contains an exemption application that can simply be filled out and sent back in the envelope provided along with copies of supporting documentation. Homeowners also have the option to apply online.

Due Date: June 1, 2022

Green Booklet

The green booklet is sent to households that may be eligible for the Longtime Homeowner Exemption. As a reminder, less than 2% of homeowners in Cook County qualify for this exemption. If you receive this booklet and believe you are eligible, complete the application and mail it back in the envelope provided along with copies of supporting documentation.

Due Date: May 25, 2022

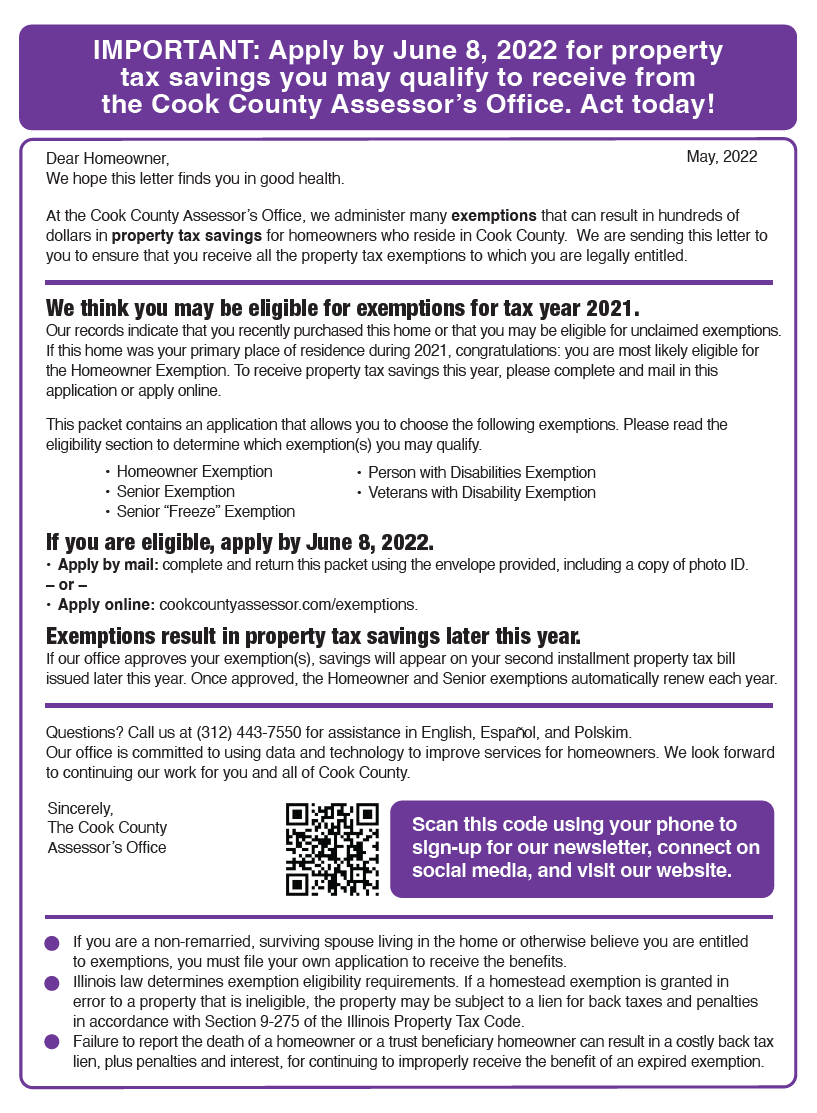

Purple Booklet

The purple booklet indicates that the household may be eligible for exemptions. If you received this booklet, you are most likely a new homeowner or haven't applied for exemptions in the last couple of years. The booklet contains an exemption application that can simply be filled out and sent back in the envelope provided along with copies of supporting documentation. Homeowners also have the option to apply online.

Due Date: June 8, 2022

Teal Booklet

The teal booklet indicates that the household may be eligible for exemptions. If you received this booklet, you have been identified as potentially eligible for exemptions. The booklet contains an exemption application that can simply be filled out and sent back in the envelope provided along with copies of supporting documentation. Homeowners also have the option to apply online.

Due Date: June 15, 2022